Advantages of Preparing Cash Budget

An organizations budget dictates how it leverages capital to work toward goals. But as most financial pros know making a budget and sticking to it are two very different things.

Flexible Budget Meaning Advantages Disadvantages Preparation And More Budgeting Bookkeeping And Accounting Budget Meaning

Generally we dont take cash requirements to calculate such a budget.

. The process of preparing a budget should be highly regimented and follow a set schedule so that the completed budget is ready for use by the beginning of the next fiscal year. The business will have a financial history which gives you an idea of what to expect and can make it easier to secure loans and attract investors. The manager takes the previous periods budget as a benchmark.

Knowing how to craft and stick to a budget is a keystone of business success. Review the assumptions about the companys business environment that were used as the basis for the last budget and. Sure you may have a rough sense of how much money you have each month but without clear precise numbers its.

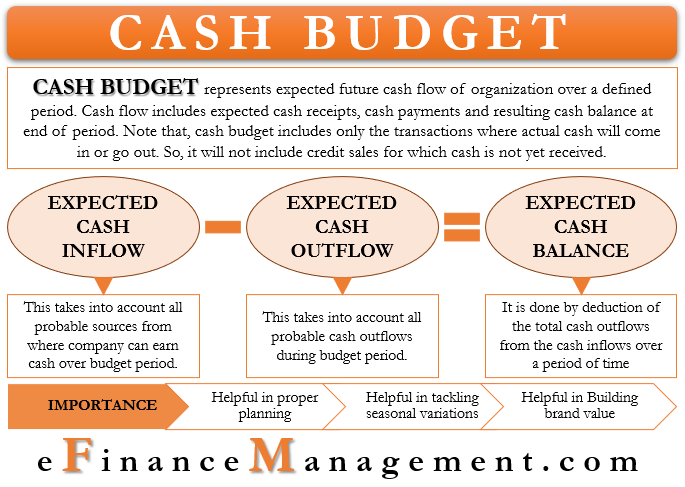

Preparing the budget will take into consideration all the probable cash outflows during the budget period. Human resources team deals with matters related to employees including recruitment compensation and benefits. It includes adjustment for inflation overall market.

Into every life a few budget variancesdifferences between actual spend and the amount budgetedmust fallHuman error changing market conditions new customers and even. There are several advantages and disadvantages in preparing a budget on a cash basis. Written by Keith Murphy 12 min read Budget Management Financial Reporting.

Instead the cash requirements are part of the master budget. For this reason the ability to prepare a budget is one of the most crucial skills for any business leaderwhether a current or aspiring entrepreneur executive functional lead or manager. These outflows will include all the cash payments made for purchases of raw materials inputs or semi-finished products consumables any cash to be paid for the purchase of a fixed asset during the period provisions for repairs and maintenance labor.

Building a budget is a standard part of doing business for organizations of all sizes and types. How better management in AP can give you better flexibility for cash flow management. 1 Incremental Budgeting.

Budget forecasting and evaluation can also be time consuming and expensive. Here are some key pros and cons. If you want help to streamline your marketing budget so that you can earn all of the benefits of marketing without the financial headaches contact the team at Big Red Cloud today.

They also help the company to sort. Different methods of preparing financial plans are as follows. Read more for all the quarters.

Discover what businesses still use these systems their advantages and disadvantages and the definitions of single-entry. Were sorry-this page is no longer publicly availableHead over to our Blog page to discover all our valuable insights to help you succeed in your role. Your financial plan should mirror your life goals.

You may end up spending too much time looking for trends and problematic assumptions and not enough time getting your day-to-day work done. A manual accounting system is a system of recording transactions by hand. The difficult start-up work has already been done.

Prepare the sales budget of the company for the year ending in 2020. Budgeting helps you keep track of where your money goes. This is a strong indicator of the ability of an entity to remain in business since these cash flows are needed to support operations and pay for ongoing capital.

And believe it or not you get to deduct the points even if you convinced the seller to pay them for you as part of the deal. Buying an established business means immediate cash flow. If there are many categories of direct labor then preparing a budget takes too much time and becomes a complex process.

With our easy-to-use accounting software for accountants bookkeepers and SMEs as well as your free trial you can be sure that youll never accidentally overspend on your marketing. Provides precise timing of when cash comes in and out of the company. These are short-term budgets prepared regularly usually monthly over some time.

Once a business prepares a capital expenditure budget it will prepare a cash budget. The deductible amount should be shown on your 1098 form. This includes financing projects and operations maintaining accounting records creating financial and budget controls preparing financial statements and Managing credit and cash.

Finance is the study and discipline of money currency and capital assetsIt is related with but not synonymous with economics the study of production distribution and consumption of money assets goods and servicesFinance activities take place in financial systems at various scopes thus the field can be roughly divided into personal corporate and public finance. One issue with the calculation is regarding cash requirements. Further the anticipated percentage change is either summed up or deducted to formulate the current budget.

Its your best tool for improving your current financial situation and successfully reaching major money-related milestones like paying off all of your debt or saving 1 million. Cash budgets as the name suggests are forecasts related to the cash flows of a business. The cash budget template is for educational purposes only and should not be relied upon without professional advice.

It is a traditional method. In addition the evaluation process may identify variables that were part of the current business cycle that dont have much relevance beyond. Pros and Cons of a Cash Budget.

Financial planning involves much more than creating a budget although thats a great place to start. The business should have plans and procedures in place. Also the sales discount and allowance percentage will be 2 of gross sales Gross Sales Gross Sales also called Top-Line Sales of a Company refers to the total sales amount earned over a given period excluding returns allowances rebates any other discount.

Here are the basic steps to follow when preparing a budget. Best Budget Planners Check Them out Here. Since the middle of the twentieth century.

Typically businesses prepare monthly cash budgets for a year. For example if you paid two points 2 on a 300000 mortgage6000you can deduct the points as long as you put at least 6000 of your own cash into the deal. If you dont have a budget theres nothing stopping you from spending over your means.

Before preparing your first organizational budget its important to understand what goes into a budget. Free cash flow is the net change in cash generated by the operations of a business during a reporting period minus cash outlays for working capital capital expenditures and dividends during the same period.

Cash Budget Meaning Preparation Example Importance

Advantages And Disadvantages Of Budget What Is Budget Advantages And Limitations Of Budget A Plus Topper

Advantages And Disadvantages Of Budget What Is Budget Advantages And Limitations Of Budget A Plus Topper

15 Cash Budget Advantages And Disadvantages Brandongaille Com

0 Response to "Advantages of Preparing Cash Budget"

Post a Comment